Some Known Details About Paypal Business Loan

Wiki Article

Some Ideas on Paypal Business Loan You Need To Know

Table of ContentsSee This Report about Paypal Business LoanSome Ideas on Paypal Business Loan You Need To KnowEverything about Paypal Business LoanThe smart Trick of Paypal Business Loan That Nobody is Talking AboutWhat Does Paypal Business Loan Mean?

You'll have multiple alternatives when looking at startup finances, consisting of SBA financings, equipment funding, lines of credit report, short term loans, as well as company bank card. The repayments will certainly be based upon the amount of the financing, in addition to the rates of interest, term, as well as security. To qualify, it's normally necessary to have a credit rating score of 680 or greater.With a company procurement lending, you'll get anywhere from $5,000 to $5,000,000. The terms can be revolving or for 10-25 years. The funds won't get here particularly quickly, normally taking regarding a month to hit your account. One of the ideal facets of these finances is that rate of interest rates start as reduced as 5 (PayPal Business Loan).

These favorable rates mean you'll conserve a significant amount of money over the life time of the loan. Obtaining a service purchase finance can give a jumpstart to your business, as buying a franchise business or existing service is an excellent means to tip right into an useful business without the backbreaking work of constructing it from scratch.

While the application varies depending upon whether you're purchasing a franchise or existing organization, you can plan on lenders reviewing factors such as your credit background, organization tenure, and earnings. You'll require to supply documents of the company's performance and evaluation, in enhancement to your very own company plan as well as economic forecasts.

How Paypal Business Loan can Save You Time, Stress, and Money.

There's no trouble with your company carrying debt. The concern is whether your company can manage its financial debt responsibilities. To get a bead on your organization debt insurance coverage, a loan provider examine your money circulation and also financial obligation settlements.

To obtain this statistics, a lender will certainly split your impressive financial debt by the cumulative amount of your readily available revolving credit score. Lenders likewise appreciate the state of your service debt (PayPal Business Loan). Having financial debt isn't a large bargain. What issues is whether the amount of financial debt you're carrying is ideal contrasted to the size of your company and also the industry you're operating in.

All about Paypal Business Loan

Lenders are a lot more encouraged to deal with you if your organization is trending in the ideal instructions, so they'll wish to identify what your standard income development will be over time. If yours lands at or above the standard for your market, you remain in wonderful shape. If you fall listed below the standard, strategy on there being some possible difficulties in your search of financing.There are lots of different types of small-business fundings whatever from a service line of credit report to invoice factoring to merchant cash loan each with its own benefits and drawbacks. The best one for your organization will rely on when you need the cash as well as what you require it for. Here are the 10 most-popular kinds of company loans.

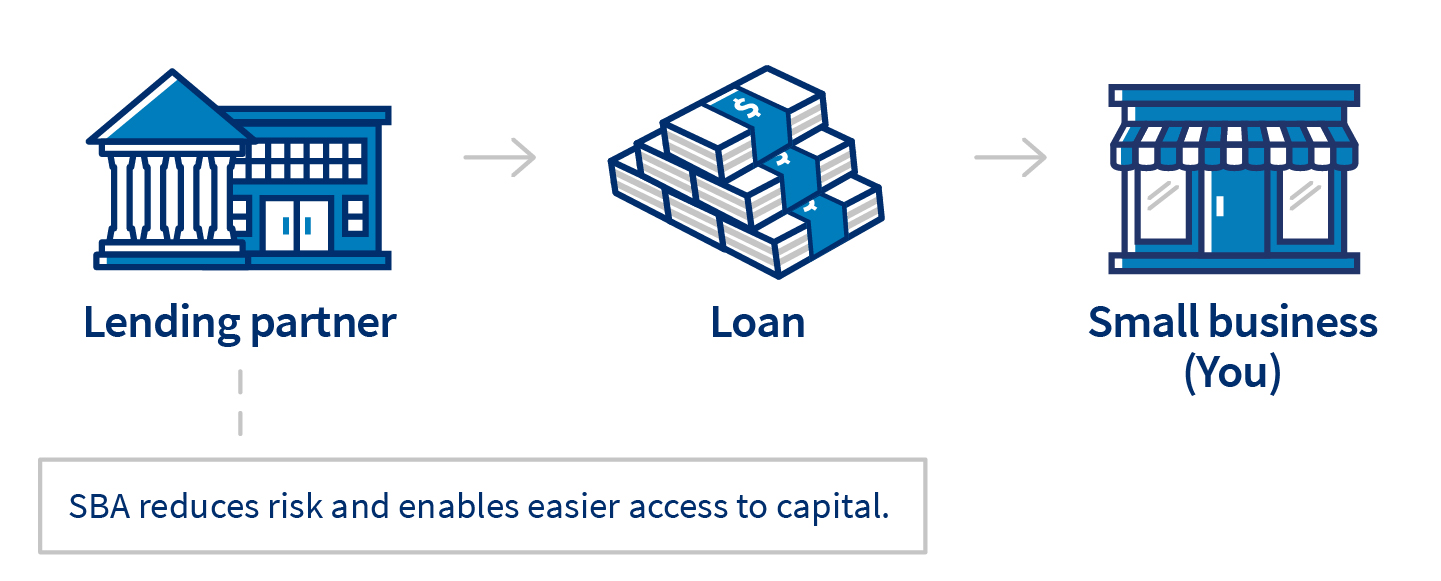

Best for: Organizations wanting to increase. Consumers who have good credit scores as well as a solid organization as well as that do not intend to wait long for funding. The Small company Administration ensures these fundings, which are provided by financial institutions and other lending institutions. Settlement periods on SBA financings depend upon just how you prepare to make use of the money.

Prices will certainly depend on the value of the devices check these guys out and the strength of your business. You can get competitive rates if you have strong credit and service funds.

Indicators on Paypal Business Loan You Need To Know

Various other services may be provided, such as consulting as well as training. Disadvantages: Smaller lending amounts. You may need to meet rigid eligibility needs. Best for: Start-ups as well as organizations in disadvantaged neighborhoods. Organizations looking for just a percentage of financing.As we've gone over, there are several types of business loansand the right one for your service inevitably comes down to a variety of check over here variables. At the end of the day, each kind of bank loan is created for a various service demand. You'll require to consider your credit scores, your company's financial resources, the length of time you've been running, and your reason for the finance before tightening down your alternatives.

You'll additionally discover numerous options that you can take benefit of if a tiny service financing is not your ideal financing alternative. There are certain points that every small company owner should understand before heading down the web application process. Here are the 5 major truths to recognize: They're all different.

Paypal Business Loan - The Facts

Let's get started: Small company loans are as diverse as the tiny organization proprietors that use for them. Not every finance firm functions in the exact same manner, as well as even within the very same borrowing business, you'll discover numerous kinds of financings.Report this wiki page